Shhhh…There Might Just Be A Bourbon Bubble

Shhhh, don’t speak of this loudly. Nobody will admit it anyway so it’s probably not worth mentioning. There might just be a bourbon bubble. What?!?! No way. This is just getting started. We haven’t even reached the distilling levels of the 70’s!

Shhhh, don’t speak of this loudly. Nobody will admit it anyway so it’s probably not worth mentioning. There might just be a bourbon bubble.

What?!?! No way. This is just getting started. We haven’t even reached the distilling levels of the 70’s! This time, it’s different!

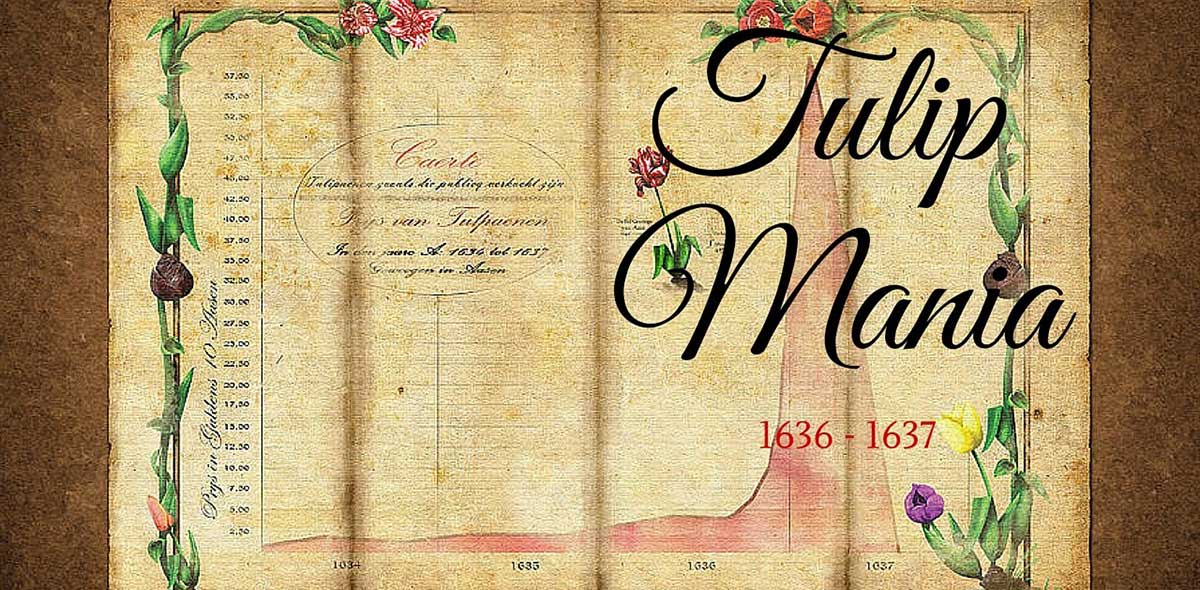

There it is, the 4 words that are a surefire sign that declares that it isn’t different and it’s a cycle like all others. Business and financial cycles have been happening like this since The Great Tulip Mania of 1637. Haven’t heard of it? A quick Bing search (my wife works for Microsoft and also proofreads my posts, sorry) will get you up to speed but the gist of that mania was simple. Tulip bulbs got exciting and everyone went crazy buying and trading them.

At one point a single bulb from the most sought after Tulip called the Viceroy was traded for the following:

- 4 Fat Oxen

- 8 Fat Swine

- 4 Tuns of Beer

- 1,000 lbs of cheese

This got me thinking. After watching Bourbon on the secondary market for a little while I was curious what could be had in today’s dollars. The easiest example of the Viceroy (love that name) would be Pappy 23. Secondary price is around $1,800 these days, about 5 times retail. Amazingly, that will buy you one whole cow, 6 pigs, 271 4 packs of Surly Beer or enough cheese curds from Wisconsin to last a lifetime.

Another way to look at this is a simple supply and demand curve. Demand for Bourbon has been steadily and rapidly rising for several years. Good bourbon takes time so supply can’t possibly be created quickly enough to meet it so price has to go up. What happens when supply DOES catch up? Prices fall.

A perusal of press release information from several large distilleries shows the following:

- Buffalo Trace and Barton invested $271 million in capacity expansion since 2014

- Brown-Forman (Jack Daniels) has invested $135 million since 2014

- Heaven Hill has increased distilling and aging stocks by 50%

- Kirin (Four Roses) has increased capacity by 50% since 2014

- MGP has increased inventory 300% since 2014 and launched 2 brands

- Wild Turkey has invested $100 million (and hired Matthew McConnaughey as Creative Director)

That is just a few, all told there is over $1.3B in capacity expansion announced or already happening. There are now 6.7 Million barrels aging just in Kentucky including more than 1 Million barrels filled for 4 straight years. New products are coming from several sources as well. Jim Rutledge left 4 Roses to launch his own distillery. Craft distilleries have exploded like craft beer from 24 in 2000 to 430 in 2014 to over 700 and counting today. None of this means this means that supplies can meet current demands but that they will in the not too distant future, at least for most of the Whiskey you drink on a regular basis. The “unicorn” bottles will always be elusive but that is also by design. There is no better marketing available for any product then cult-like following and very short supply. It is very smart and strategic for Buffalo Trace and others to make at least a little bit less then they think people want.

To be clear, I don’t expect the bubble to pop anytime soon and there might never be a pop at all. A gradual balance is possible where demand slows in line with new production. We don’t have the supply to catch demand yet and there are still plenty of people warming to Bourbon all the time. What I am suggesting is that you might not need to buy a case at a time of that 4-year-old everyday drinker in fear that it will run out. The secondary market will always exist and I for one have no problem with capitalism creating a solution to today’s bourbon problems. If somebody wants to spend $500 on George T Stagg or $2,000 for a dusty bottle of Hirsch, that’s up to them.

The best possible outcome is a rightsizing of price and a significant increase in quality. If the coming supply does overwhelm demand it may force the producers to lay down their liquids for longer, potentially creating better Bourbon. That would mean that the stockpiles collectors are building today could either end up being overpriced or poor in quality compared to what is coming. No matter the outcome I am excited by the massive expansion that has happened. More creativity by producers leads to more choice by consumers.

All bubbles end the same way. People overpay for a good expecting to sell it to others for more and more until they run out of “the next sucker”. Then prices normalize. The Viceroy eventually crashed and sold for its original price, aka retail. Let’s hope that we can all participate at retail again soon, in the meantime #drinkcurious.